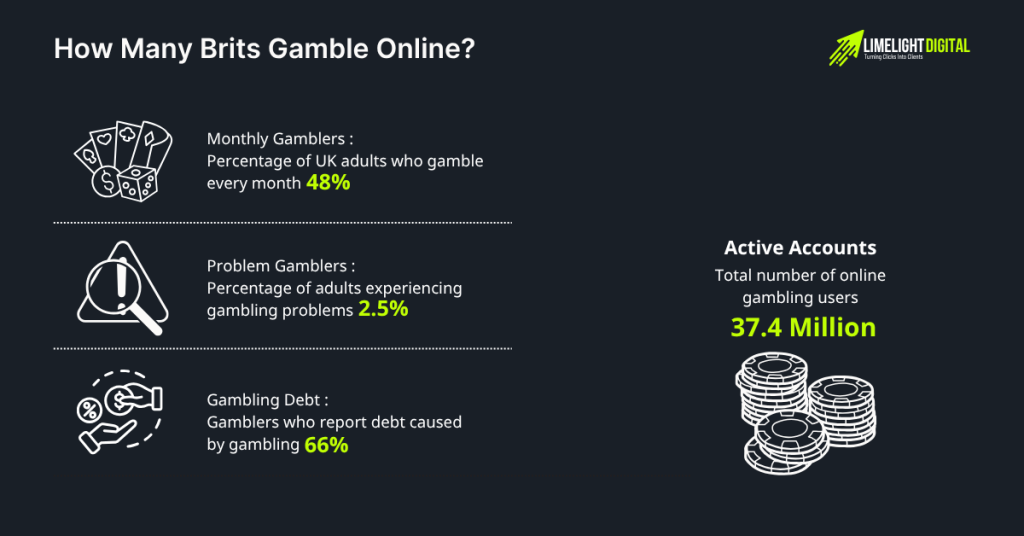

Online casino gaming has become a significant part of UK entertainment, with 37.4 million active gambling accounts as of 2025. This is a 24.1% increase from pre-COVID levels.

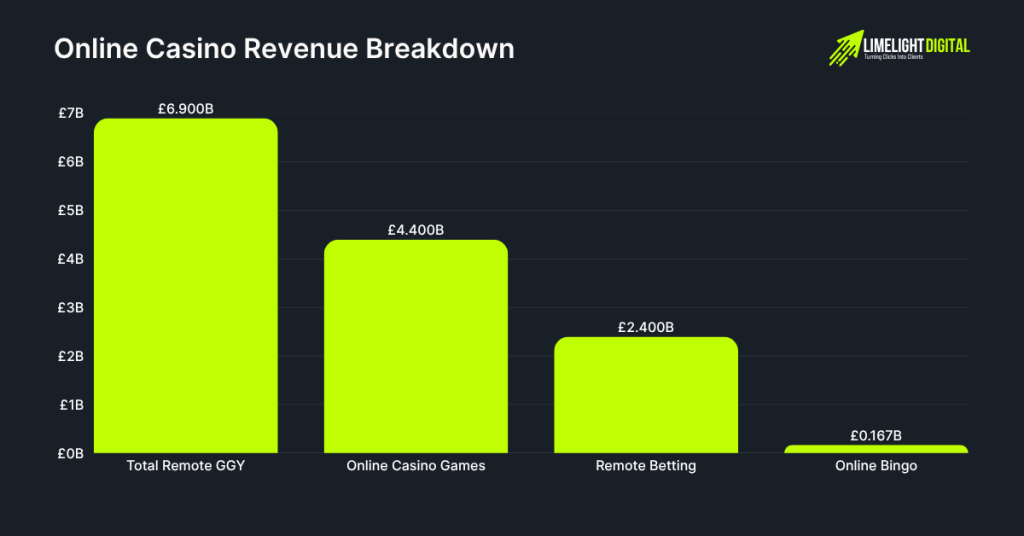

The industry generates £6.9 billion annually from remote casino, betting, and bingo operations, with online casino games alone contributing £4.4 billion.

Currently, 48% of British adults gamble monthly, while 2.5% struggle with gambling addiction. Sports betting dominates the market, accounting for a 56.64% revenue share, and the sector is projected to reach $15.09 billion by 2030.

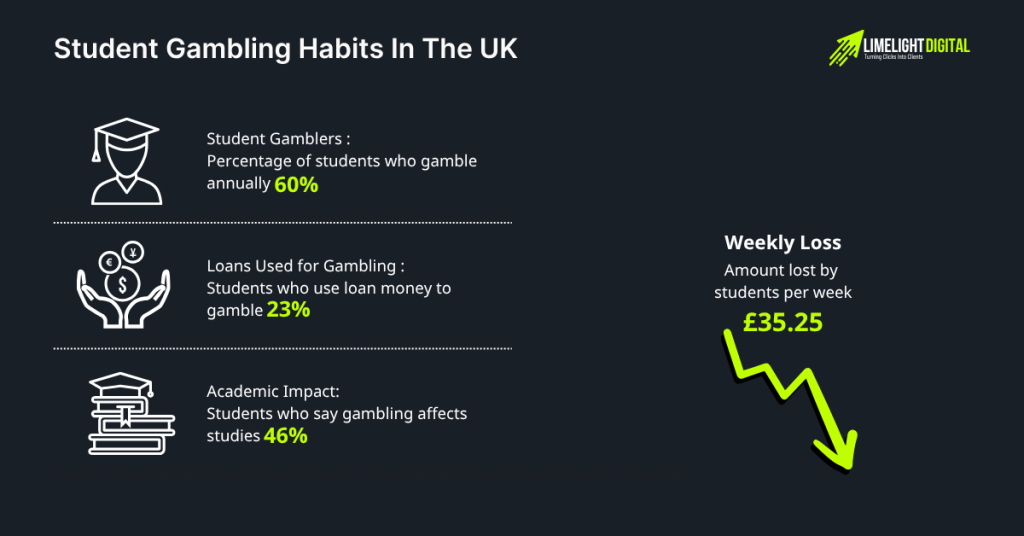

However, concerning trends show 60% of students gamble annually, with many using student loans to fund their activities. Let us get into more details like these.

Gambling Statistics UK (Top Picks)

- 48% of all British adults gamble at least once every month, making it a mainstream recreational activity across the country.

- University students are particularly vulnerable, with 6 out of 10 spending money on gambling in the past year, often using their student loans to fund these activities.

- The average student gambler loses £35.25 weekly, almost matching their grocery budget of £36, which adds up to nearly £1,833 lost annually.

- Tragically, between 117 and 496 people take their own lives each year in England due to gambling-related problems, highlighting the severe mental health impact.

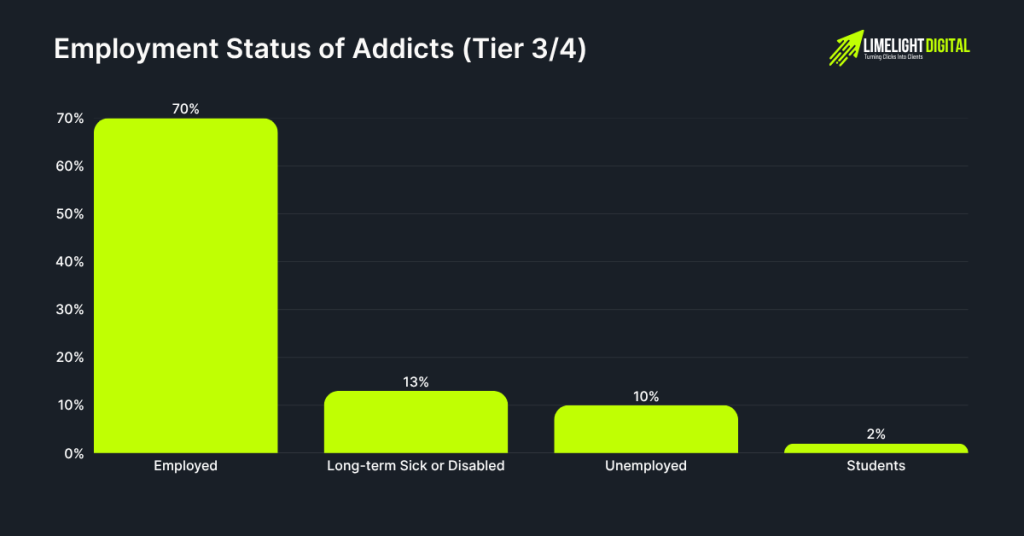

- Most people seeking help for gambling addiction are employed adults, with 70% having jobs, challenging the stereotype that only unemployed individuals develop gambling problems.

- Online gambling has become the preferred method for most players, with 70% now choosing digital platforms over traditional betting shops and casinos.

- The UK loses millions in tax revenue annually due to unregulated gambling sites, with £2.7 billion being staked on illegal platforms that avoid paying proper duties.

Jargon used below explained-

1. Gross Gambling Yield – GGY

2. Remote Casino, Betting and Bingo – RCBB

3. Compound Annual Growth Rate – CAGR

4. National Gambling Support Network – NGSN

How Many People Gamble Online in the UK?

- As of 2025, 2.5% of the UK adult population has a gambling problem. (BMJ)

- As of 2025, there are 37.4 million active online gambling accounts in the UK, which is a 2.6% increase from the previous year and a 24.1% increase compared to pre-lockdown levels.

- The total funds held in online customer accounts were recorded at £896.3 million, a 2.1% increase from last year and up 29.4% from the pre-COVID period. (Gambling Commission)

- As of 2025, the Share of monthly gamblers in Great Britain is 48%. (Statista)

- In 2023, 60% of students reported gambling in the past 12 months, with the primary motivation of 46% of them being “to make money”.

- Additionally, 23% of those who gamble said they use their student loan to fund gambling.

- These students also lost an average of £35.25 per week, equivalent to about £1,833 annually. Nearly 10% of student gamblers spend £51–£100 weekly, surpassing average food expenses.

- 46% admitted that gambling had negatively impacted their university experience, leading to missed deadlines, social activities, or financial strain covering essentials like food. (YGAM)

Here is a breakdown of the Impact on UK student gambling statistics:

| Metric | Percentage/Amount |

|---|---|

| Students who gambled in past 12 months | 60% |

| Use student loans for gambling | 23% |

| Average weekly losses | £35.25 |

| Annual losses per student | £1,833 |

| Negative impact on university experience | 46% |

- Online gambling as the primary gambling location increased from 57% in 2015–16 to 70% in 2023–24.

- In the UK 66% of the gamblers had gambling-related debt.

- Whereas 11% lost jobs and 24% experienced relationship loss.

- Only 61% of individuals completed their scheduled gambling addiction treatment in the five-year average from 2021 to 2025, which is little short of the previous 5 year average of 68%. (Annual Statistics from the National Gambling Support Network (Great Britain))

UK Online Gambling Facts On Market

- From Jan to Mar 2025, total online gambling Gross Gambling Yield (GGY) reached £1.45 billion, marking a 7% increase year‑on‑year.

- The total Gross Gambling Yield (GGY) of the British gambling industry from April 2023 to March 2024 was £15.6 billion

- This marks a 3.5% increase compared to the previous year and a 10.2% rise compared to the last pre-lockdown year (2019–2020).

- When excluding all reported lotteries, the total GGY was £11.5 billion, up 5.7% year-on-year, and 13.5% higher than pre-COVID levels. (Gambling Commission)

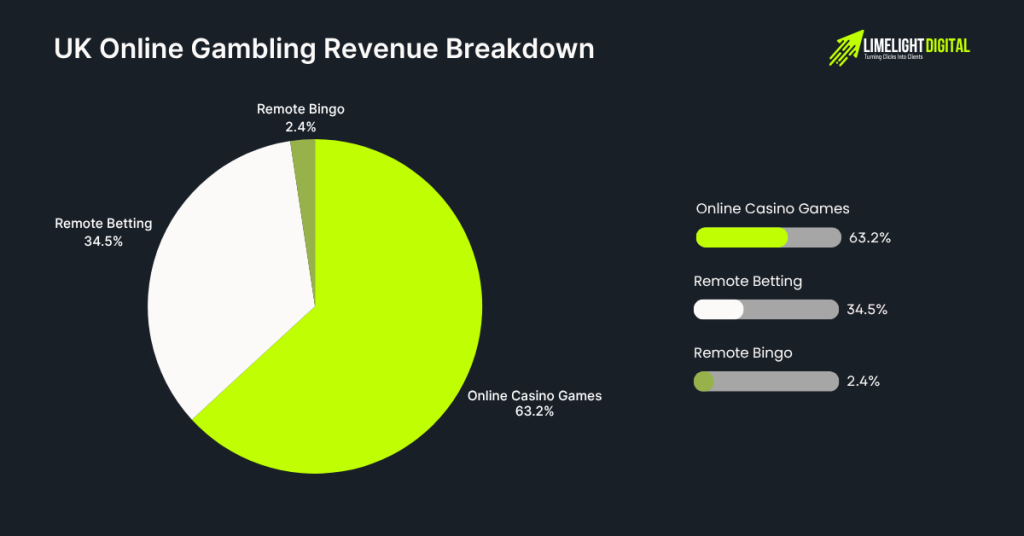

Here is a quick breakdown of the UK online gambling market share:

| Category | Market Share % |

|---|---|

| Online Casino Games | 63.8% |

| Remote Betting | 34.8% |

| Remote Bingo | 2.4% |

- 5.8% of gamblers reported using VPNs in UK to access gambling sites.

2.2% used social media or messaging platforms (e.g. WhatsApp) exclusively for gambling (Betting & Gaming Council, The Guardian) - Sports betting was the largest segment in UK online gambling with a revenue share of 56.64% in 2024. (Grand View Research)

- The UK online gambling market is dominated by a mix of domestic and international operators, including Bet365, Sky Betting and Gaming, and Ladbrokes Coral Group, each employing over 1,000 staff members in the UK alone.

Here’s a list of major UK-based or UK-operating companies leading the online gambling market:

| Company Name | Headquarters Location | Website |

|---|---|---|

| Bet365 | Stoke-on-Trent, UK | bet365.com |

| Sky Betting & Gaming | Leeds, UK | skybet.com |

| Ladbrokes Coral Group | Harrow, UK | ladbrokescoralplc.com |

| Sportech PLC | Edinburgh, Scotland | sportechplc.com |

| The Stars Group (now Flutter) | London, UK | starsgroup.com |

Market Forecast Of UK Online Gambling Statistics

- The UK online gambling market is projected to reach a revenue of USD 15.09 billion by 2030, growing from USD 7.37 billion in 2024.

- A compound annual growth rate (CAGR) of 12.8% is expected in the UK online gambling sector from 2025 to 2030, indicating one of the fastest-growing digital entertainment markets in Europe.

- In 2024, sports betting emerged as the largest revenue-generating segment, accounting for 56.64% of the market share—making it both the largest and fastest-growing segment in the forecast period.

- The UK accounted for 9.4% of the global online gambling market revenue in 2024, and is projected to remain the largest market in Europe by 2030 in terms of revenue.

United Kingdom Online Gambling Revenue (Remote vs Non-Remote Trends)

- The online gambling sector in the United Kingdom generated a substantial £6.9 billion in gross gambling yield (GGY) between April 2023 and March 2024.

Below is a detailed breakdown of this revenue by category.

| Category | Gross Gambling Yield (GGY) |

|---|---|

| Total Remote Casino, Betting & Bingo | £6.9 billion |

| Online Casino Games | £4.4 billion |

| Remote Betting | £2.4 billion |

| Remote Bingo | £167.1 million |

| Online Slots | £3.6B |

- The Remote Casino, Betting, and Bingo (RCBB) sector generated a total GGY of £6.9 billion, which represents a 6.9% increase from the previous year and a 20.3% increase compared to 2019–2020.

- Of this, £4.4 billion came from online casino games, with £3.6 billion solely from online slots.

- Remote betting contributed £2.4 billion, with £1.1 billion from football betting and £771.1 million from horse betting.

- Remote bingo generated £167.1 million in GGY.

- The total GGY for non-remote (land-based) sectors such as arcades, betting shops, bingo halls, and casinos was £4.6 billion, which is 3.8% higher than the previous year and 4.7% higher than pre-lockdown.

- Betting shops alone contributed £1.2 billion, making up 49.6% of the non-remote betting sector’s GGY.

- The number of betting shops in the UK stood at 5,931, marking a 1.4% decline compared to last year and a 22.8% decline from pre-pandemic levels.

- Arcades contributed £663.9 million in GGY, a 10.2% year-on-year increase and a 54.1% jump compared to the last pre-lockdown year.

- Adult gaming centres made up £623.4 million of this figure, showing an 11.1% increase.

- Family entertainment centres contributed £40.5 million, reflecting a 1.8% decline.

- The National Lottery sold £7.8 billion in tickets, with £4.5 billion returned as prizes and £1.6 billion contributed to good causes.

- This represents an 8.0% decrease in charitable contributions year-on-year.

- Large society lotteries, by contrast, sold £1.1 billion in tickets and contributed £461.5 million to good causes, a 9.4% increase from the previous year.

(Source Of This Section – Gambling Commission)

- In the UK, gambling companies spend £1.5 billion on advertising each year, while customers lose £15.6 billion annually to the gambling industry.

- Over 50% of the UK public support ending gambling advertising.

- In the UK, 78% agree that nobody under 18 should be exposed to gambling adverts. (BMJ)

UK Demographics Betting Statistics

- Among male students, 25% participated in online sports betting, with an average of 91 betting days per year, almost every term-time weekday.

- They paid a mean of £33.54 weekly on gambling, which is nearly identical to their average weekly expenditure on groceries of £36. (YGAM)

- In the UK, 62% of 11- 17-year-olds reported seeing gambling advertising online in 2024. Here is a further breakdown of this exposure:

| Medium of Exposure Of Gambling Ads | % of Young People Exposed |

|---|---|

| Online | 62% |

| Offline | 64% |

| Television | 54% |

| Apps | 52% |

- In 2024, 27% of 11 to 17-year-olds reported spending their own money on gambling activities.

- Whereas, 21% spent money on regulated forms of gambling (including arcade machines).

- 20% UK students played arcade gaming machines (penny pusher/claw grab).

Gambling Addiction Statistics

- As of 2025, 117-496 people die by suicide related to gambling annually in England. (BMJ)

- As per the latest statistics, 10,754 individuals received treatment through the National Gambling Support Network (NGSN) during 2023–24.

- 7,463 people underwent Tier 3 or Tier 4 treatment, marking a 12% increase from the previous year (6,645 clients)

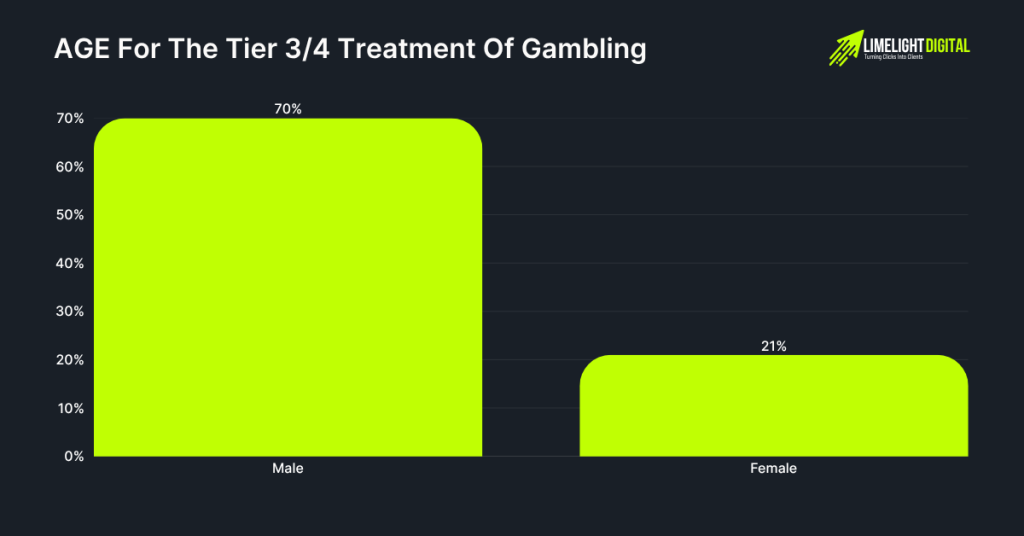

Gender distribution in Tier 3/4 clients:

- 70% male

- 21% female

- 75% of Tier 3/4 clients were aged 45 or younger, with a concentration particularly in the 30–34 and 35–39 age groups (collectively, 38%).

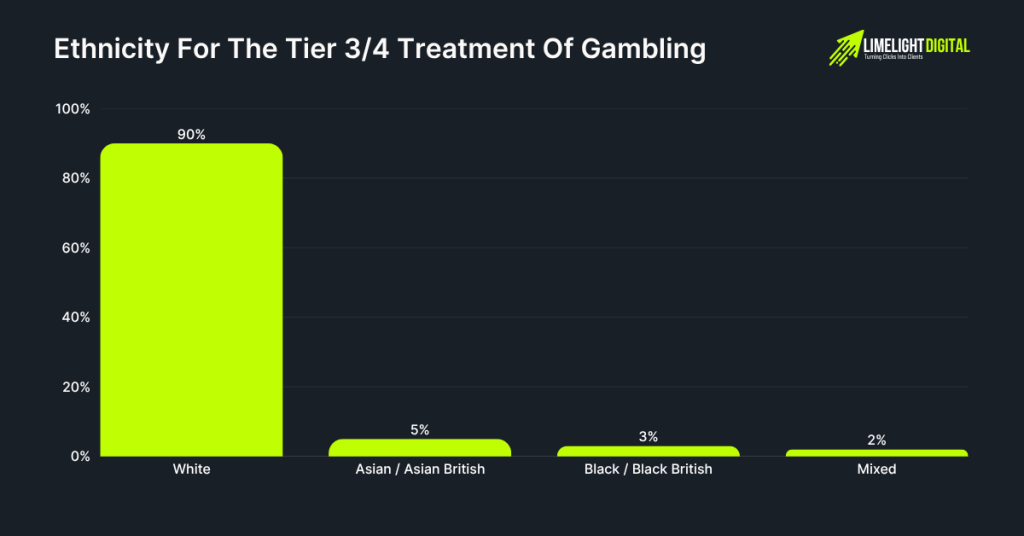

- The client’s profile based on their ethnicity for the tier 3/4 treatment is as follows:

- 90% White

- 5% Asian/Asian British

- 3% Black/Black British

- 2% Mixed

- The most surprising fact, however, is that these gambling addicts comprised 70% employed individuals, 10% unemployed, 13% long-term sick or disabled, and 2% students.

Source for this section- Annual Statistics from the National Gambling Support Network (Great Britain)

Black-Market Gambling In UK

- The £2.7 billion online black-market stake costs the UK Treasury an estimated £36.9 million annually in lost excise duties.

Fiscal losses to the Treasury range between £36.9 million (online only) and £67.0 million (including in-person), representing real public revenue impacts.

In the UK, a majority of gamblers are aware of at least one black-market site:

- 15% of 18–24-year-olds

- 8% of 25–34-year-olds

- £2.7 billion is staked annually on unregulated online black-market gambling sites in the UK, which represents 2.1% of the £128 billion staked with regulated online operators.

- 0.8% of gamblers (excluding lottery-only gamers) use only black-market online channels, while 5.4% “multi-home” (using both regulated and black-market sites), allocating approximately 12% of their total gambling spend to the black market.

(Source Of This Section- Betting & Gaming Council, The Guardian)

Also Read:

- How Content Drives Millions in Casino & Gaming Referrals?

- How Much Do Influencers Make (Earnings & Data)

Conclusion: There Are 37.4 Million Online Gamblers In The UK

The UK online gambling market continues to show strong growth with 37.4 million active accounts and £6.9 billion in revenue per year, establishing Britain as the largest gambling market in Europe.

While the industry is growing with forecasts of 12.8% annual growth to 2030, significant issues remain. The high prevalence of habitual gambling among students (60%) and adults with gambling problems (2.5%) continues to require responsible gaming initiatives.

The death toll continues to rise, with an estimated 117-496 gambling-related suicides too. Moreover, the completion rates for people accessing addiction treatment are only 61%.

Despite the human collateral and cost involved, as the UK market transitions to online and digital gambling, the potential outcomes for commercial success while ensuring player protection and welfare are increasingly tenuous.

It will be necessary to expand focused work to evolve the industry at a pace that is both sustainable and effective.